About CARB Diesel Emissions Testing

Stay Compliant with CARB HD I/M in Two Simple Steps

- Register Your Fleet on CTCVIS - Complete your vehicle registration through the official CTCVIS database and make required payments to maintain compliance status.

- Schedule Your Emissions Testing - Commercial vehicles require testing twice per year & RV owners need only one annual test. Compliance tests performed by certified testers. Book early to ensure timely compliance and avoid delays.

Let us help you maintain your CARB compliance with convenient mobile testing at your location. Contact us today to schedule your required emissions testing.

The California Air Resources Board (CARB) launched the Clean Truck Check program to tackle air pollution from heavy-duty vehicles. Here's a breakdown of key points for fleet owners like you:

Who CA SB 210 Applies To:

- Nearly all diesel and alternative fuel heavy-duty vehicles with a Gross Vehicle Weight Rating (GVWR) exceeding 14,000 pounds operating on California roads.

- This includes in-state, out-of-state, public and private fleets.

For More Information About Clean Truck Check:

Please be aware:

If you've recently had repairs or maintenance done on your truck,

Your On-Board Diagnostic (OBD) system may have been reset (codes cleared). Before testing, your vehicle must complete at least 5 Warm-Up Cycles (WUC) to ensure it is "Ready" for testing...as in, a ready-for-testing state.

If your vehicle is Not Ready, it will not pass the compliance test. Driving the vehicle for up to 2 weeks is the best way to get over 15 WUCs and back into the Ready state.

What is a Warm-Up Cycle (WUC)?

A Warm-Up Cycle occurs when:

- The engine starts cold

- The coolant temperature increases by at least 40°F

- It reaches at least 140°F (diesel) or 160°F (natural gas)

Avoid Clearing Codes Before a Test!

Disconnecting the battery or using a scan tool to reset the system will require additional driving before the vehicle can pass.

Clean Truck Check - Heavy-Duty Inspection and Maintenance (HD I/M) Program

The Clean Truck Check program aims to lower emissions from diesel vehicles that operate in California even further. This program targets heavy-duty vehicles like trucks, buses, and motorhomes, ensuring they’re running clean and efficiently. One key point to be aware of is that the Clean Truck Check (CTC) regulations apply to all trucks operating in the state, not just trucks based in California.

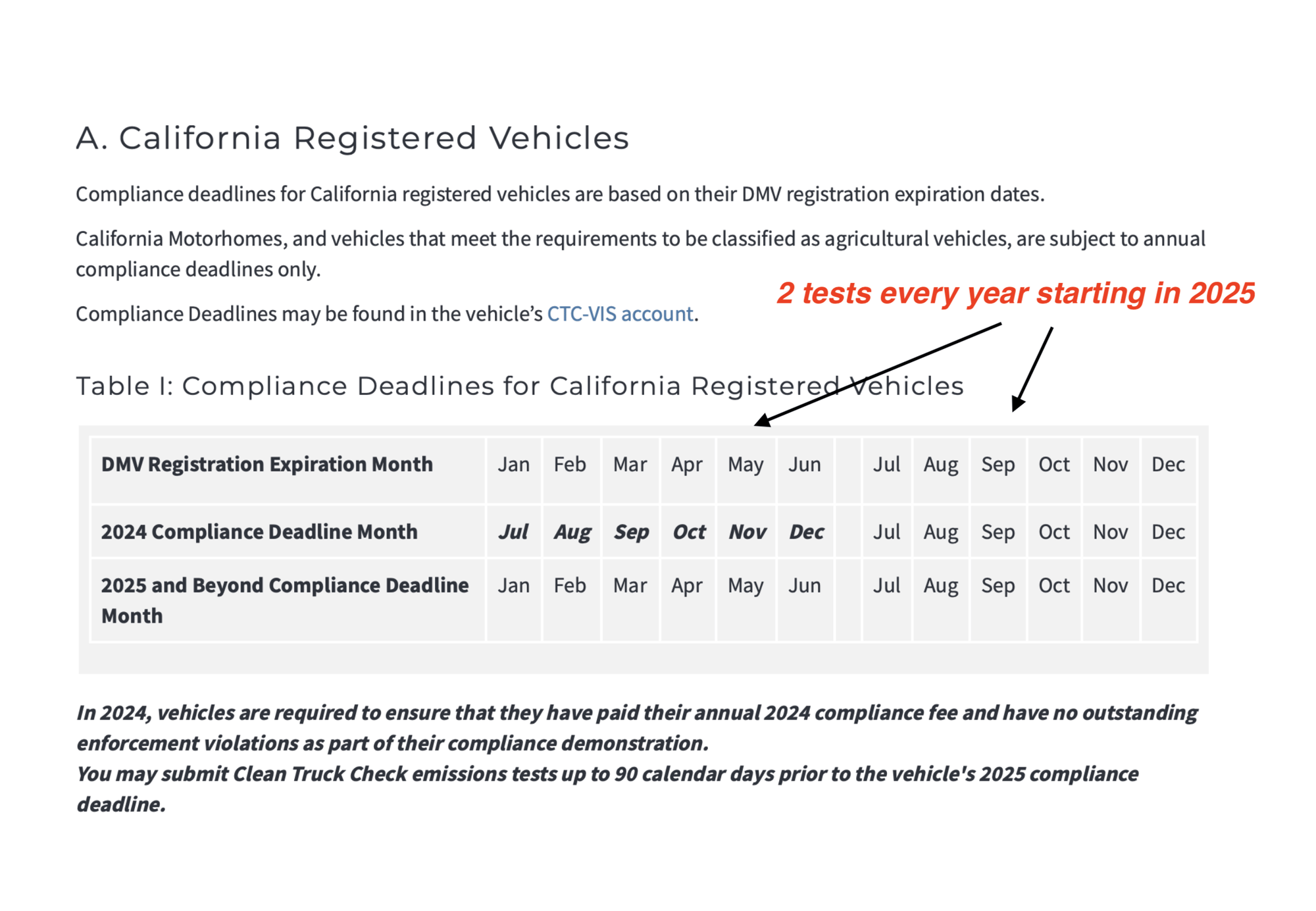

Deadline Update for Clean Truck Check Reporting: The California Air Resources Board (CARB) is extending the Clean Truck Check reporting deadline to January 31, 2024, to allow vehicle owners additional time to complete their initial fleet reporting and meet the compliance fee requirement.

Database Reporting CTC-VIS

Vehicle owners (or designees) will be required to report in 2024 in the Clean Truck Check database when creating their accounts to comply with the Heavy-Duty Vehicle Inspection and Maintenance regulation. Required information must be entered for vehicles in your fleet that are subject to Clean Truck Check with a $31 per vehicle compliance fee(s) paid for all vehicles in the fleet by January 31, 2024.

See the Image of CTC-VIS website below